Let’s talk about something that’s on every savvy investor’s mind in 2025: how to secure your financial future in these unpredictable times. The economic landscape has shifted dramatically, and the old rules of investing just don’t cut it anymore.

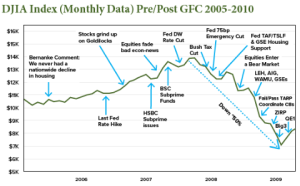

Remember when we thought investing for 10-15 years was a surefire path to wealth? Well, the market had other plans. Just think back to 2007-2008 when the stock market took a nosedive, wiping out over 50% of many people’s life savings. It’s a stark reminder that relying solely on traditional market investments can be a risky game.

And let’s not forget the curveball that COVID-19 threw at us. Even now, in 2025, we’re still feeling the aftershocks. Job disruptions, struggling businesses, unexpected healthcare costs – these challenges have forced many to rethink their financial strategies.

So, what’s the solution? Well, that’s where passive income comes into play. It’s not just a buzzword; it’s becoming a necessity for those who want to maintain financial stability in these turbulent times.

Here’s why passive income is gaining so much traction:

- It provides a consistent cash flow, giving you financial security when you need it most.

- It frees up your time, allowing you to focus on other pursuits or simply enjoy life.

- It helps diversify your portfolio, protecting you from market volatility.

- Many passive income streams can be scaled up, potentially snowballing your returns over time.

Now, you might be wondering, “Why should I focus on taking my returns now instead of waiting for future gains?” It’s a fair question.

The truth is, in today’s volatile market, securing immediate, tangible benefits from your savings can be a game-changer. It gives you the flexibility to enhance your current lifestyle, reinvest for compound growth, or adapt to changing circumstances.

But here’s the kicker – this isn’t about completely abandoning traditional investments. It’s about finding a balance. Allocating a portion of your savings to guaranteed passive income streams can provide a stable foundation, especially when traditional safe havens like bonds and gilts are yielding returns below inflation rates.

As we navigate this complex financial landscape, it’s clear that innovative approaches to generating returns aren’t just beneficial – they’re essential. Passive income strategies offer a compelling alternative to traditional investment models, providing stability, freedom, and the opportunity to take control of your financial future.

Interested in exploring how passive income could work for you? We’ve made it easy to get started. You can chat with our AI assistant, Finley, for quick answers to your investment questions who will guide you to schedule a meeting. Or, if you prefer to find out faster, schedule a free consultation directly: Click Here

Remember, in a world of financial uncertainty, passive income isn’t just an option – it’s a pathway to true financial freedom. Let’s work together to make your money work smarter for you in 2025 and beyond.