Estate Planning in 10 Steps

In this article, Estate Planning in 10 Steps, you will be able to outline your wishes in the most tax-advantaged way so that there will be no confusion, misunderstandings, or misunderstandings about what you wish to accomplish, now and in the future.

Nobody wants to think about their mortality. It may even seem trivial to debate who gets which assets after death. Many recent studies have found that only 35-40% of people worldwide have a will.

However, it’s up to your loved ones to try and gain access to your assets after you’re gone.

By writing a Will and signing a few other essential documents, you can save them a lot of trouble and unnecessary expense – and allow them to focus on their loss.

Using ten steps, I’ll make this relatively painless.

Step 1 – Understand the importance of a will.

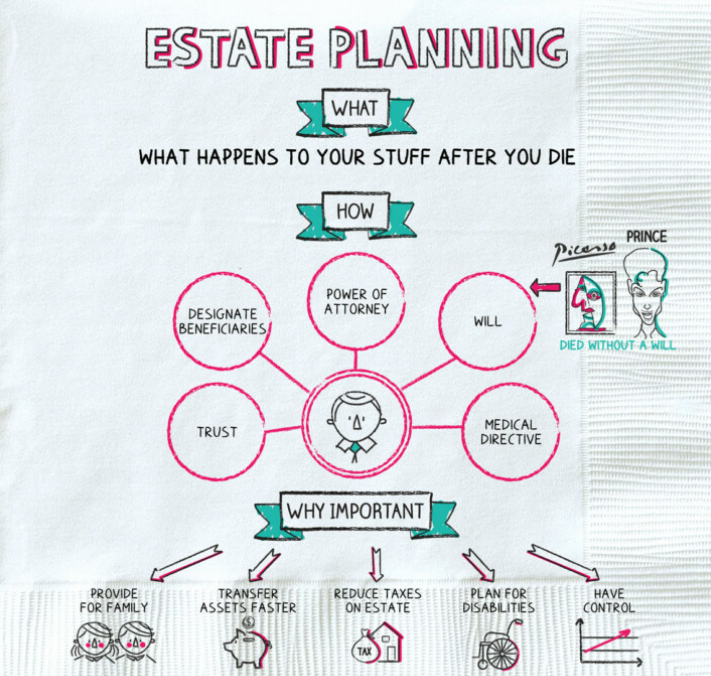

Essentially, a Will tells the world whom you want to inherit your assets. When you die without one, you die “intestate” – without regard to your wishes or your heirs’ needs – and the Government (where you hold your assets) controls your assets’ fate.

Therefore, you need a Will for each country in which you hold assets.

Most common-law countries allow you to give to whomever you want. Hong Kong, the United Kingdom, the United States, Australia, Canada, and 75 others allow testamentary freedom. A common-law country enables you to give your assets to whomever you want – your cat, your dog, charities – your beneficiaries do not have to be your family.

It is required to include your children as beneficiaries in a Will in 150 countries under Civil-Law law (China, France, Germany). The law, called Forced Heirship, requires you to distribute assets to your descendants.

Furthermore, making a will is especially important for people with young children since they can nominate guardians for minors in their documents.

Having a separate Deed of Guardianship ensures that children do not get caught up in the time delays associated with guardianship instructions only in your will. In this way, the instructions for your minor children and other dependents remain private – there will be no intervention from the court.

Step 2 – Take inventory and pick your team.

Start by creating a comprehensive list of your assets, including investments, retirement savings, insurance policies, real estate or business interests, and collectible and sentimental items for each country. It is incredible what we can amass and forget. Millions of dollars are left in financial institutions as no one knows they exist.

This list should be updated with your Will so that your executor knows what they can claim.

Then spend some time thinking about the following questions:

- Whom do you want to inherit your assets?

- Whom do you want responsible for executing your will?

- Whom do you want to name as guardians for your children if you and their other parent die?

- Whom do you want to handle your financial affairs if you’re ever mentally incapacitated?

- Who do you want to make medical decisions if you cannot make them yourself?

Once you have considered these basic questions, you will have established who would be in charge, who would inherit and what you would leave for them.

Step 3 – Name an Executor.

A will allows you to name your Executor, who will be in charge of claiming your assets, distributing your property, filing tax returns on behalf of your estate, and processing claims from creditors. Your Executor can be a friend, a relative, or a professional like an accountant or lawyer. Still, it should be someone you trust, who is willing and able to take on the responsibility.

If you name a professional, the executor obtains assets in your estate. You should negotiate the amount or rate in advance; compensation can range from hourly fees to a percentage of your assets paid annually. Family or friends can claim any costs from your estate when distributed.

Step 4 – Consider your Beneficiaries.

We all know who our loved ones are, but how do we decide who gets what and when?

Most families want to give more to their spouse than their children, contingent beneficiaries being nieces, nephews, and siblings.

What if your spouse then remarries? You cannot guarantee they will write a new will to include the children; by default, the new spouse can receive your assets.

Or what if your children are too young to inherit if you don’t have a spouse? Heirs have to be 18 to inherit financial assets.

Draw up a list of beneficiaries so you can think more about what you own and how to pass it on.

Step 5 – Draft your will.

Follow these steps and discuss with your will-writer:-

- Write a title (your full name)

- Name the executor of your will

- Name a guardian for any minors

- Organize and inventory assets

- Name the beneficiaries

- Write your distribution wishes

Once you have these essential details, your advisor can create a will for you to consider.

Step 6 – Consider a family trust.

Contrary to popular belief, Trusts aren’t just for rich people (though if you have significant assets or young children, you should want to think seriously about creating one.)

A Trust is a legal structure that lets you put conditions on the distribution of assets. If these benefits sound appealing, you can learn more about trusts on the next stage of the road to wealth.

A Trust provides immediate distribution of your assets, so if you are the primary breadwinner in the family, another consideration is how your loved ones survive financially while all your purchases are being assessed, claimed, and distributed.

Step 7 – Assign Power of Attorney.

No one is immune to the loss of mental clarity that may come with aging or from a health crisis.

Granting someone you trust the Power of Attorney allows that person — known as your “agent” or “attorney in fact” — to pay bills, manage investments, or make critical financial decisions if you cannot do so. Your agent is empowered to sign your name and is obligated to be your fiduciary — meaning they must act in your best financial interest and follow your wishes.

The power of attorney instructions ceases when you die or become mentally capacitated again.

Step 8 – Create a living will.

A living will (also known as an advance medical directive or health proxy) is a statement of your wishes for the kind of life-sustaining medical intervention you want or don’t want if you become terminally ill and unable to communicate.

Most countries have statutes that define when a living will go into effect and sometimes restrict medical interventions. Your condition and the terms of your directive also will be subject to interpretation. But a patient’s wishes are taken very seriously, so an advanced medical order is one of the best ways to have a say in your medical care when you can’t otherwise express yourself.

It allows your loved ones emotional relief as they don’t have to decide on your life support care because you have instructed what can and cannot happen.

Step 9 – Update your will.

Review your will every year. You’ll also want to update it after a significant life change such as birth, death, or marriage, or if you buy some real estate or receive an inheritance. When doing this, ensure your beneficiary designations on financial accounts, insurance policies, and other assets are up-to-date and coordinated with your will.

If you wish to update your will, you should consider changes in beneficiary designations or asset jurisdictions.

Step 10 – Communicate with your heirs.

Inheritance can be a loaded issue, so discuss your plans and expectations with your family and friends. The sooner and more distinctly you outline your intentions, the less chance there will be for disagreements when you’re gone.

In summary, preparing for the inevitable would alleviate the paperwork and confusion that occurs when people die without instructions. Your children would be safe, all beneficiaries would receive the right amount with the right people in charge, and your estate would pay minimal administration and legal fees.

Please contact us at www.careysuen.com with any questions you may have.