Navigating Market Volatility with Passive Income

Market volatility can feel like riding a roller coaster—one moment you’re climbing steadily, and the next, you’re plunging into uncertainty. But what if I told you that volatility isn’t just something to fear?

With the right strategies, it can be an opportunity to build wealth and generate passive income

Whether you’re aiming for steady long-term gains of 8%-10% per year or leveraging short-term opportunities with returns of 8%-12%, a disciplined approach can help you weather the storm and thrive.

Understanding Market Volatility

Before diving into strategies, let’s break down what market volatility is. Think of it as the stock market’s mood swings—prices rise and fall unpredictably due to economic reports, political events, or even global crises. While this unpredictability can be nerve-wracking, it also creates opportunities for savvy investors to buy undervalued assets and position themselves for future growth.

The Role of Passive Income in Volatile Markets

Passive income is like having a financial safety net—it provides consistent earnings regardless of market conditions.

By focusing on income-generating investments, you can create a buffer against market swings while building wealth over time.

Here’s how you can approach passive income during periods of volatility:

- Long-Term Opportunities (8%-10% per annum)

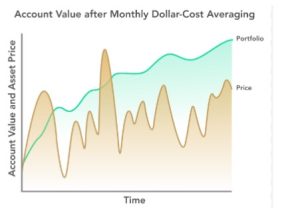

Long-term investing emphasizes patience and consistency. Historically, markets have trended upward despite short-term dips. By staying invested and focusing on diversified portfolios, you can achieve steady growth. Strategies like dollar-cost averaging—investing a fixed amount regularly—help reduce the impact of volatility by averaging out your purchase costs over time. - Short-Term Opportunities (8%-12% per annum)

For those willing to take on more risk, short-term strategies like contrarian investing or tactical asset allocation can yield higher returns. This involves buying undervalued assets during market downturns or rotating into sectors poised for recovery.

Key Strategies to Navigate Volatility

To make the most of these opportunities, here are some proven strategies:

- Diversify Your Portfolio

Diversification is your best defense against volatility. Spread your investments across different asset classes to minimize risks. - Embrace Dollar-Cost Averaging

By investing consistently over time, you’ll buy more shares when prices are low and fewer when they’re high—reducing the emotional stress of timing the market. - Stay Calm and Invest Regularly

Emotional reactions often lead to poor decisions like panic selling during downturns. Instead, focus on your long-term goals and stick to your plan. - Leverage Liquidity

Keep some cash or liquid assets handy to seize opportunities when prices drop sharply.

5. Reinvest Earnings

Reinvesting dividends or interest payments compounds your returns over time a crucial factor in achieving long-term growth.

Why Patience Pays Off

The key to navigating volatile markets is maintaining a long-term perspective while taking advantage of short-term opportunities when they arise. Remember that trying to time the market often leads to missed gains; instead, focus on building a diversified portfolio that aligns with your financial goals.

By adopting a mix of long-term (8%-10% per annum) and short-term (8%-12% per annum) strategies, you can turn market fluctuations into stepping stones toward financial independence.

Take the Next Step

Ready to make your money work harder?

Speak to Finley, our chatbot on our website Careysuen or book a free consultation today : Click Here

Whether you want to explore investment strategies or need help building a financial plan tailored to your goals, we’re here to help you navigate every step of your journey toward financial success!