British families have paid £5bn+ in inheritance tax (IHT) since 2016.

IHT paid by British families topped £5bn in 2016 and has continued to rise yearly. Roy Jenkins (Chancellor of the Exchequer from 1967-1970) said that this is a voluntary tax, meaning if you don’t plan to remove or mitigate it from your estate, you volunteer to pay it when you die.

Experts said that a record number of middle-class families are in default to the tax man due to soaring house prices and stamp duty discouraging older adults from downsizing.

Families with recently deceased relatives have narrowly missed out on new, higher limits. Letting the families inherit homes worth £1m tax-free.

Despite house prices rocketing over the past ten years, the inheritance tax threshold has remained the same since 2010. This means more estates each year are hit by the tax.

If people don’t plan as they age and downsize, they may pay more IHT. As more of their money will be tied up in their property, leaving them with less to give away.

There are various reasons why people need to downsize. A big one is a massive cost of moving. This includes stamp duty and the lack of suitable housing for retired people.

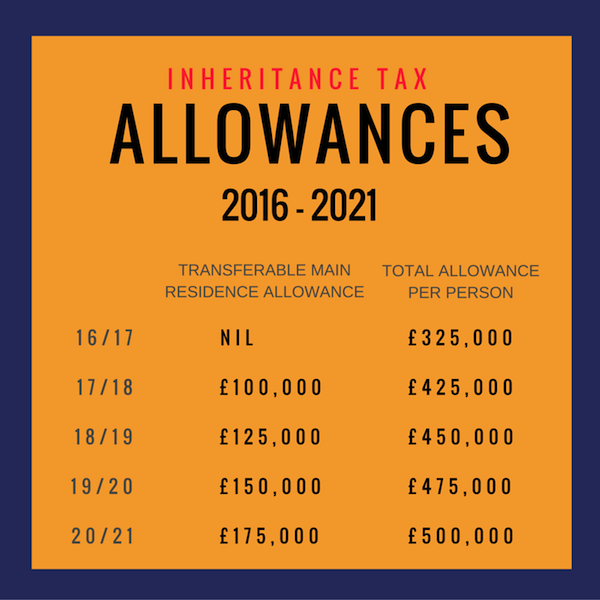

Currently, estates worth up to £325,000 are in allowance without paying IHT, with a rate of 40% payable above the threshold.

But this changed in April 2017 when the Government began phasing in an additional tax-free allowance. This will allow HOMEOWNERS to bequeath an extra £175,000 in property wealth by 2021.

This means a new allowance for property owners of £500,000 – or £1m for couples. However, it is only available if you leave your home to your children, which is an instruction via your will. Are you aware of this critical step to qualify?

A substantial amount of wealth is now being taken by the government through inheritance tax. Many people are unaware that it is payable or how to remove or mitigate it.

What upsets people is that this is wealth that is in tax twice. Income tax is in payment on earnings, and capital gains tax (CGT) is compensation for asset growth. To then pay a tax when you die?

But the current mood means some people are worried about being vilified if they try to reduce their tax bill. Increasingly it is being seen as an ‘unpatriotic’ thing to do.

Do you feel unpatriotic by mitigating or removing Inheritance Tax from your estate?

Of course, many of us also feel that we have paid taxes once or twice already (income tax and stamp duty), so why do it again when we die?

BTW – Inheritance Tax is not only a charge on your UK assets – if you are in class as a UK Domicile (UK born with UK Domicile parents, regardless of where you live), then your global assets are in negotiation when you die!

There are many ways to plan. Particular pensions and private trusts allow you to remain a beneficiary of the contents BUT pass onto your loved ones IHT and CGT free. You have gift allowances and are permitted to give over the allowance. For non-resident UK Domicile, there are trust structures that keep your assets away from UK tax burdens.

https://www.gov.uk/inheritance-tax describes how IHT works and how it affects your estate – you need to know what it all means to plan effectively.